Fueling SaaS Growth with Smart Marketing Strategies!

Your SaaS deserves more than just visibility—it needs unstoppable growth. We craft data-driven marketing strategies that attract, convert, and retain customers, helping your software scale faster than ever. Let’s build your brand’s success story today!

Features

Innovative Features That Redefine Possibilities

Content Generator

Create engaging content tailored to your audience with just a click.

SEO Optimizer

Boost your visibility with intelligent keyword suggestions and SEO-friendly structures.

Creative Headlines

Capture attention instantly with catchy, data-backed headlines that work.

Social Media Posts

Craft share-worthy social posts that drive traffic and engagement effortlessly.

Email Copy Wizard

Write persuasive emails that convert leads into loyal customers.

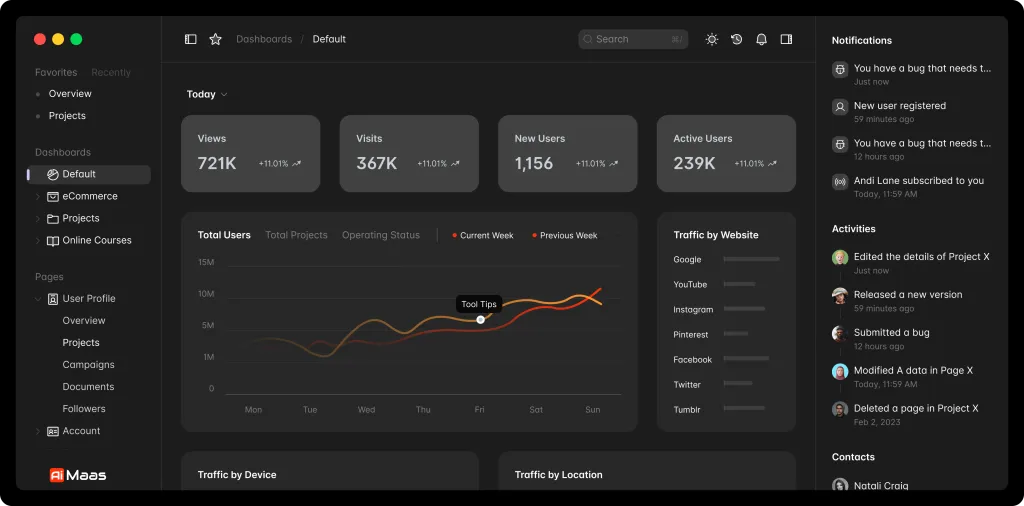

Analytics Insights

Track performance and refine strategies with actionable insights in real time.

Solutions

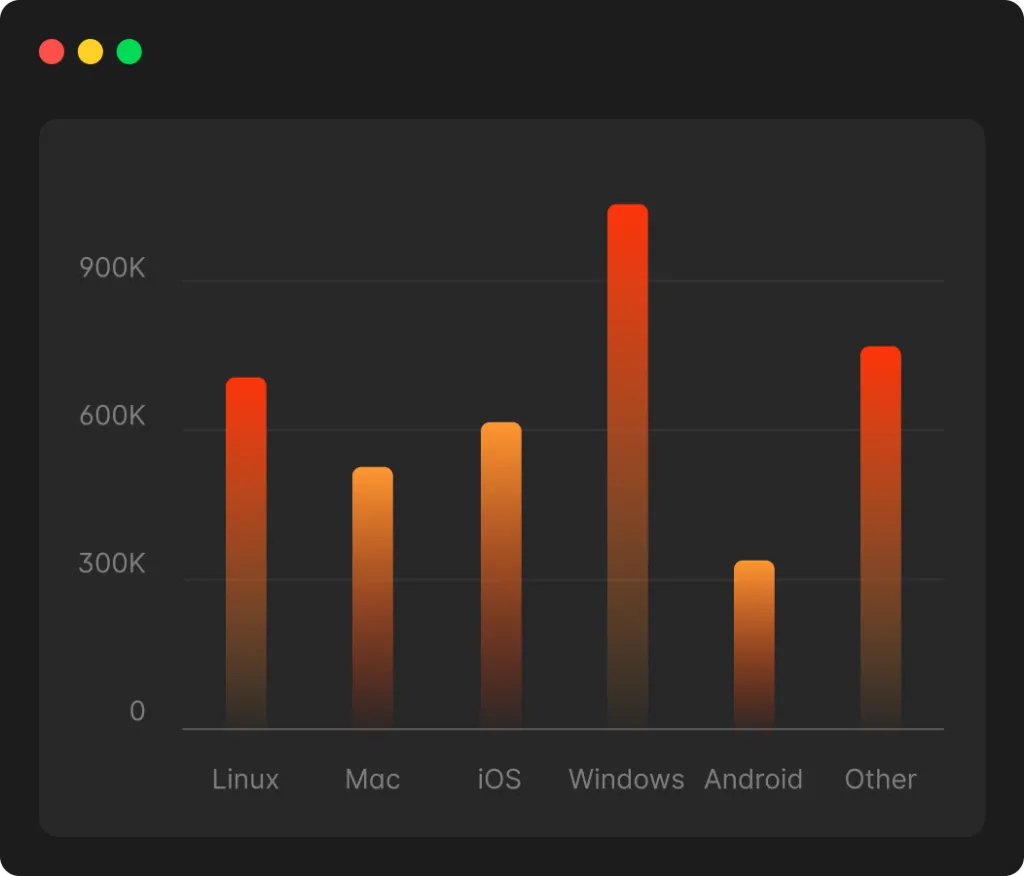

AI Solutions for Everyone, Everywhere

Unlock the power of advanced AI tools designed for businesses of all sizes and individuals alike. Our platform ensures accessibility across devices, making innovation available at your fingertips. Whether you're a small startup or an established enterprise, we bridge the gap between technology and growth.

Accessible across all major platforms, including Windows, Mac, and mobile devices.

Empower small to medium businesses with cutting-edge AI capabilities.

Simplify innovation with tools designed for everyone, anywhere.

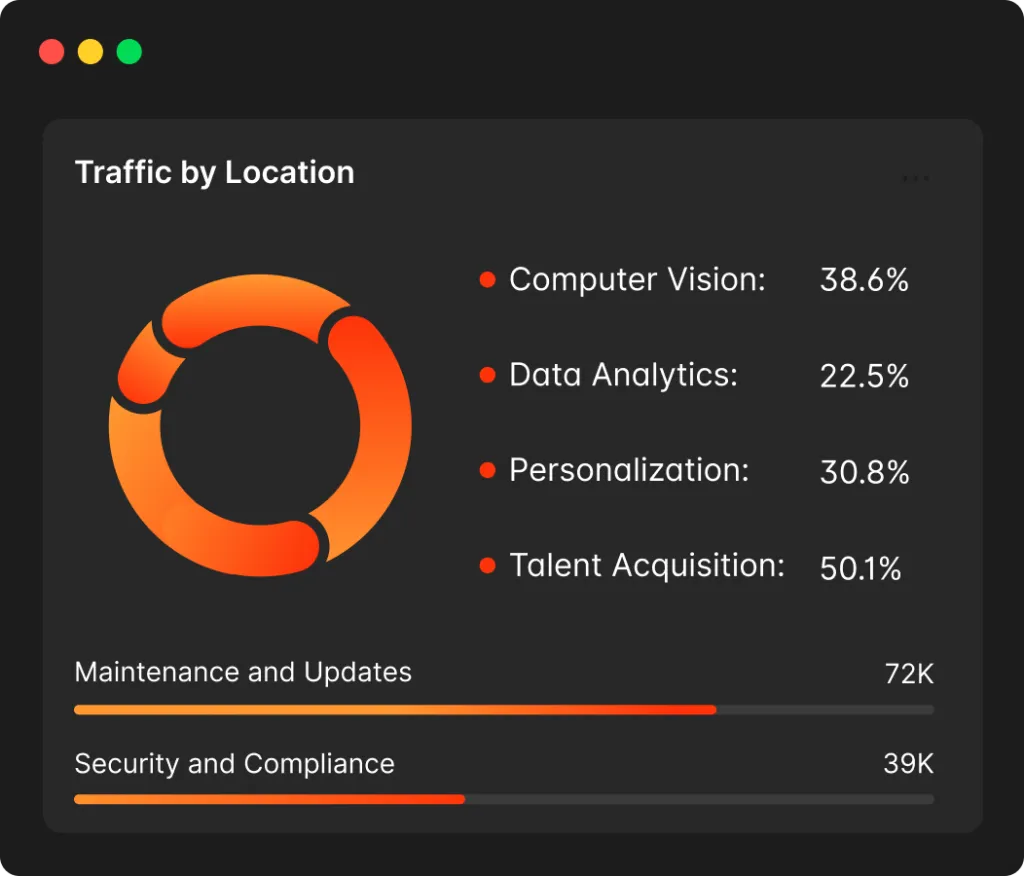

Deploy Smarter, Scale Faster

Accelerate your operations with AI solutions that are ready to deploy in no time. Streamline integration, reduce setup delays, and focus on achieving your goals with tools designed for fast-paced industries.

Instant AI Deployment – Save time with pre-configured systems.

Seamless Integration – Quickly embed AI features into your workflow.

Cost-Efficient Solutions – Reduce time and development costs.

Pricing Plan

Choose a Plan That Suits Your Needs

Starter Plan

$19/month

Access to basic AI features

Limited support via email

Perfect for individuals & small projects

5 AI-powered projects per month

Basic analytics and insights

Community forum support

Professional Plan

$49/month

Full suite of AI tools

Priority email support

Ideal for growing businesses

Unlimited AI projects

Advanced analytics and reports

Priority email and chat support

Enterprise Plan

$99/month

Advanced AI solutions

Dedicated account manager

Tailored for large-scale operations

Custom AI integrations

Team collaboration tools

Dedicated 24/7 support

Services

Revolutionize Your Content with AI Precision

Elevate your brand with AI-powered copywriting. From breaking barriers with accurate translations to producing captivating social posts and detailed blogs, our AI tools ensure your message resonates with any audience, anywhere.

Global Translations

Seamlessly connect with international audiences through accurate and culturally.

Social Buzz Creator

Design impactful and engaging social media posts that stand out in a crowded digital space.

Intelligent Blogging

Streamline your blog-writing process with AI-powered drafts and creative insights tailored to your needs.

TESTIMONIALS

Hear What Our Clients Have to Say

I can't express how much this platform has revolutionized the way we approach our projects. The AI tools are incredibly intuitive and have saved us countless hours of work. The team’s support is exceptional, and I truly feel like they’re invested in our success.

Sophia Reynolds

As a small business owner, I was initially hesitant to invest in AI solutions. But this platform has proven to be a game-changer! From simplifying our operations to delivering insightful analytics, it has exceeded all my expectations. The ease of use and top-notch customer service.

James Carter

Working with this platform has been an absolute delight. The features are incredibly versatile, catering perfectly to the needs of my growing team. What sets it apart is the personalized attention we’ve received throughout our journey. It’s rare to find such a combination of innovation.

Emily Harper

Frequently Asked Questions

Your Questions, Answered Clearly

How does this platform ensure data privacy and security for its users?

Data security is our top priority. We implement end-to-end encryption, secure data centers, and strict access controls to protect your information. Additionally, we comply with industry standards like GDPR and regularly update our systems to stay ahead of potential threats.

What kind of customer support can I expect after signing up?

We provide 24/7 customer support through various channels, including live chat, email, and phone. Our dedicated team is always ready to help you resolve any issues or answer your queries promptly.

Can I upgrade or downgrade my plan based on my needs?

Absolutely! Our plans are flexible, allowing you to upgrade or downgrade as your business grows or your needs change. You can easily make adjustments through your account settings without any downtime.

Does this platform integrate with other tools and software I already use?

Yes, our platform is designed for seamless integration with popular tools like CRM systems, project management software, and analytics platforms. This ensures smooth workflows without the need for additional development.

Is there a free trial available before committing to a subscription?

We offer a comprehensive free trial that gives you full access to our platform’s core features. This allows you to explore its functionality and determine if it’s the right fit for your needs before making a decision.

How can this platform help my business grow and save costs?

By automating repetitive tasks, optimizing workflows, and providing data-driven insights, our platform helps you increase efficiency and reduce operational costs. This allows you to focus on strategic goals and business expansion.

What kind of training or resources are available for new users?

We provide detailed onboarding sessions, video tutorials, and an extensive knowledge base to help new users get started. Additionally, our team conducts regular webinars to ensure you make the most out of our platform's features.

Empower Your Vision with Smarter AI Solutions

Unlock the potential of AI to streamline your workflows, amplify creativity, and drive innovation. Our solutions are tailored to meet diverse needs, ensuring efficiency and excellence in every task.

Innovative Tools: Transform ideas into action with cutting-edge AI features.

Enhanced Productivity: Save time and achieve more with intelligent automation.

Global Reach: Break barriers and connect seamlessly with a wider audience.

Empowering businesses with innovative solutions, we are committed to providing seamless support and fostering growth. Connect with us for a brighter, smarter future!

Quick Links

Contact Us

Legal

© Kenneth Edmonds - 22nd Century Management 2025 All Rights Reserved.